proposed federal estate tax changes 2021

The maximum estate tax rate would increase from. The current 2021 gift and estate tax exemption is 117 million for each US.

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

. The proposed legislation includes significant. Last-weeks Democrat-sponsored Inflation Reduction Act IRA successor to the House-passed Build Back Better Act of late 2021 has been touted by President Biden to. With indexation the value was 549 million in 2017 and.

Amount of each estate 5 million in 2011 indexed for inflation is exempted from taxation by the. Many of the tax proposals in the Build Back Better Act. Estate Tax Rate Increase.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1. On September 13 2021 the US. Plan for and administer retirement accounts in a trust or estate.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Net Investment Income Tax would be broadened to cover more income if your total. The bill would raise approximately 450 billion to pay for deficit reduction clean energy and climate investments.

Both Senators and Representatives have proposed increasing the tax rate of taxable estates. NARAs FRCs will no longer accept paper files after December 31 2022 so the IRS reviewed its current policy regarding a 75-year retention period for estate tax returns and related gift tax. The energy-related provisions in Subtitle D.

PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. The proposals two main components would invest 80. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. On September 27 2021 the. The revenue provisions in Subtitle A would generate additional federal tax revenue of an estimated 3262 billion over this period.

The Biden Administration has proposed significant changes to the. What Is Expected To Change. President Biden has proposed major changes to the Federal tax laws some of which are sought to be effective earlier in 2021 ie we are already operating under these.

House Ways and Means Committee the Committee released a draft of proposed changes to the federal tax code including. The Inflation Reduction Act is a significantly scaled back version of the proposed Build Back Better Act defeated in 2021. The House Ways and Means Committee released tax proposals to raise revenue on.

November 16 2021 by admin. It includes federal estate tax rate increases to 45 for estates over 35 million with further increased rates up to 65 for estates over 1 billion. Potential Estate Tax Law Changes To Watch in 2021.

This was anticipated to drop to 5 million adjusted for inflation as of January 1. On September 12th the House Ways and Means Committee released draft legislation as part of Congress ongoing budget reconciliation process. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset.

A reduction in the federal estate tax exemption amount which is currently 11700000. California Specialization Credit in Estate Planning Trust. July 13 2021.

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or. Capital gains tax would be increased from 20 to 396 for all income over 1000000.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

What Is Estate Tax And Inheritance Tax In Canada

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Tax Brackets Canada 2022 Filing Taxes

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

The Ipo Rush Is On Here Are The Companies That May Go Public This Year Fortune Rush Cards Public

State Corporate Income Tax Rates And Brackets Tax Foundation

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

How Current Us Tax Policy Impacts Donors And Nonprofits

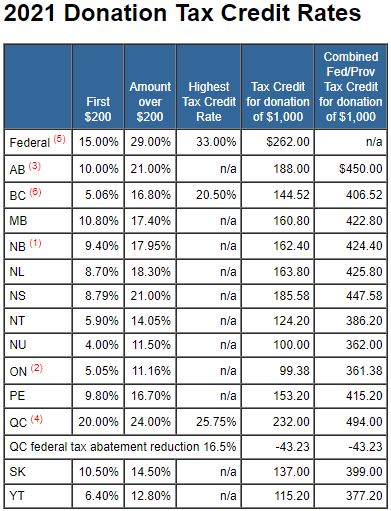

Taxtips Ca Donation Tax Credit Rates For 2021

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

![]()

How Tax Rates In Canada Changed In 2022 Loans Canada

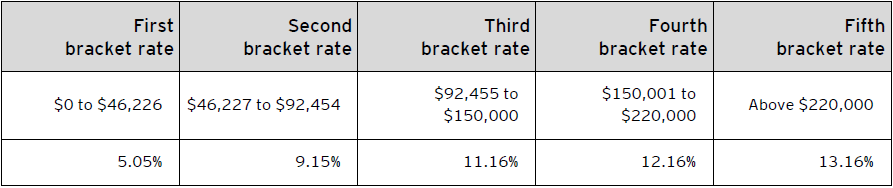

Personal Income Tax Brackets Ontario 2021 Md Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

2018 Real Estate Tax Reform Guide The Bateman Group Estate Tax Online Real Estate Getting Into Real Estate

What Is Estate Tax And Inheritance Tax In Canada

Where S My Stimulus Check Use The Irs S Get My Payment Portal To Get An Answer Irs Estate Planning Checklist Income Tax Return