ev charger tax credit california

Listed incentives may not be available at any given time. CALeVIP Alameda County Incentive Project provides rebates to entities toward the purchase and installation of EV chargers.

Residential installation can receive a credit of up to 1000.

. Listed incentives reflect an illustrative estimation of available incentives. See a list at DriveClean Electric for All and PlugStar and be sure to. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

You may be eligible for a range of incentives including EV rebates EV tax credits and various other benefits. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. Incentives are personalized for where you live.

Entities that purchase and install EV chargers are eligible to receive up to 3500 or 75 of project costs whichever is less. Several months later it seems that revisions to the credit are returning to lawmaker agendas. View incentives in a specific area by entering a ZIP code below.

Additional incentives could be available in your ZIP code. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. Electric Vehicle Charging Credit SUMMARY The bill provides under the Personal Income Tax Law PITL and Corporation Tax Law CTL a 40 percent credit for costs paid or incurred to the owners or developers of multifamily residential or nonresidential buildings for the installation of electric vehicle.

There are many many EV charging station rebates available in California. Reduce EV charging equipment and installation costs with incentive and rebate programs available in California before funding runs out. Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange.

The state has lowered its max MSRP limit for eligible EVs to 45000 from 60000 for passenger cars. And its retroactive so you can still apply for installs made as early as 2017. These rebates help bring down the capital expenditure making installing charging stations a very interesting project for many hotels workplaces or apartment complexes.

Updated April 2022. That being said California is giving credits to EV owners for an electric car home charger. These incentives are huge.

CALeVIP South Central Coast Incentive - Commercial. Electric Vehicle Charging Station Tax Credit SUMMARY This bill under the Personal Income Tax Law PITL and the Corporation Tax Law CTL would allow a credit equal to 40 percent of the costs paid or incurred by the owners or developers of multifamily residential dwellings for the installation of electric vehicle charging equipment. There you will find links to California electric vehicle incentives for EV charging infrastructure for all the different regions in the state.

For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker. Electric vehicle incentives are listed for all California ZIP codes as well as the top 25. Here well outline some the state-based EV charger tax credit and incentive programs in each of these states as of this writing.

Pasadena Water and Power customers can receive a 600 rebate when they install a qualifying Wi-Fi enabled Level 2 240-volt electric vehicle EV charger or a 200 rebate when they install a standard Non Wi-Fi EV charger in their home. The tax credit is retroactive and you can apply for installations made from as far back as 2017. That being said California is giving credits to EV owners for an electric car home charger.

DOE A plug-in electric vehicle handbook that answers basic questions and points readers to additional information to make the best vehicle selection. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. With grants of up to 4500 or 75 of the total cost of an L2 port and an adder of 500 for DACLIC or 1000 for MUD or up to 80000 per DC Fast Charger and potentially.

The goal of the CalCAP Electric Vehicle Charging Station Program is to expand the number of electric vehicle charging stations installed by small businesses in California. Californias Advanced Clean Cars Program CARB. Treasurer Launches Innovative Program to Finance Electric Vehicle Charging.

The federal tax credit was extended through December 31 2021. Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner. The Sothern California Level 2 Incentive Project has officially launched with rebates ranging from 3500 per connector or 75 of project costs.

You can view vehicle tax credits and rebates income-based incentives charging station incentives local utilities electricity discounts and special driving perks for electric vehicles. Plug-in Electric Vehicle Handbook US. More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV vehicles including utility discounts on chargers and electricity rates.

EV Charging in California. Depending on the county in which they live residents can take advantage of rebates ranging from 200 to 600 toward the installation of a Level 2 charger. You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000.

That could be worth around 15000. The tax credit covers 30 of a companys costs. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs.

California adds 1500 incentive for new EVs total state fed incentives now up to 135K. The program was funded through the California Energy Commission and operated from June 1 2015 through March 31 2022. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in California.

In some cases these rebates can cover around 70 of total costs.

Webasto Turbodx Ev Charging Station

Powercharge Energy Platinum Level 2 Commercial Ev Charger

Juicebox 40 Amp Electric Vehicle Charging Station With Nema 20 Ft Cable Costco

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

What Are The Ev Charger Levels

Track Electricity Use And Cut Costs 100 Remote No Cost No Equipment Sunistics

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Wallbox Pulsar Plus Ev Charger 699

How To Claim An Electric Vehicle Tax Credit Enel X

Rebates And Tax Credits For Electric Vehicle Charging Stations

Delta Ev Charger 30 Amp 25ft Charging Station

Tax Credit For Electric Vehicle Chargers Enel X

Do I Have To Pay To Charge My Electric Car Autotrader

Axfast 32amp Level 2 Electric Vehicle Charger Costco

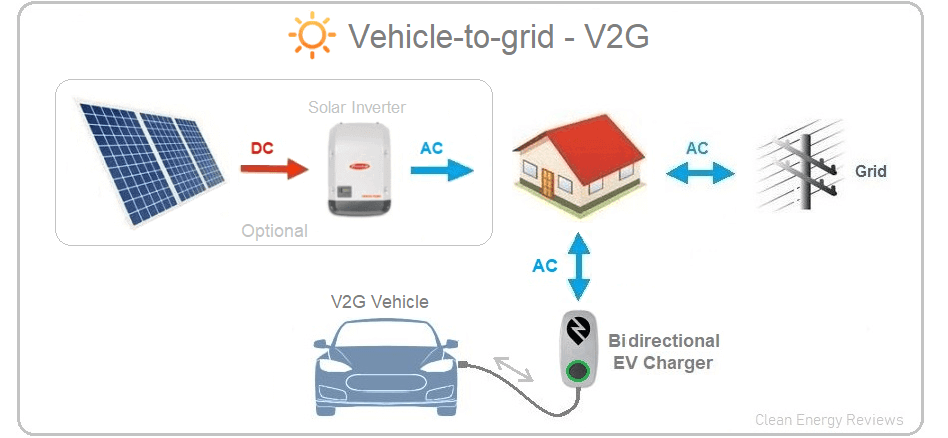

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Best Smart Electric Vehicle Chargers Clean Energy Reviews

Bosch Ev200 Series 16 Amp 12 Cord Ev Charging Station El 51245